Written by Charlotte Jones Sievers. October 14, 2025

Imagine trading sleet and slush for sunshine. Trading rigid routines for spontaneous tapas evenings. For many Swedish pensioners, the dream of moving to Spain is not just a fantasy—it’s a well-thought-out plan for a richer life. I have personally watched friends and acquaintances make the move and can attest that it is a journey filled with both sunny benefits and some bureaucratic challenges.

The Lifestyle: More Time, Lower Costs

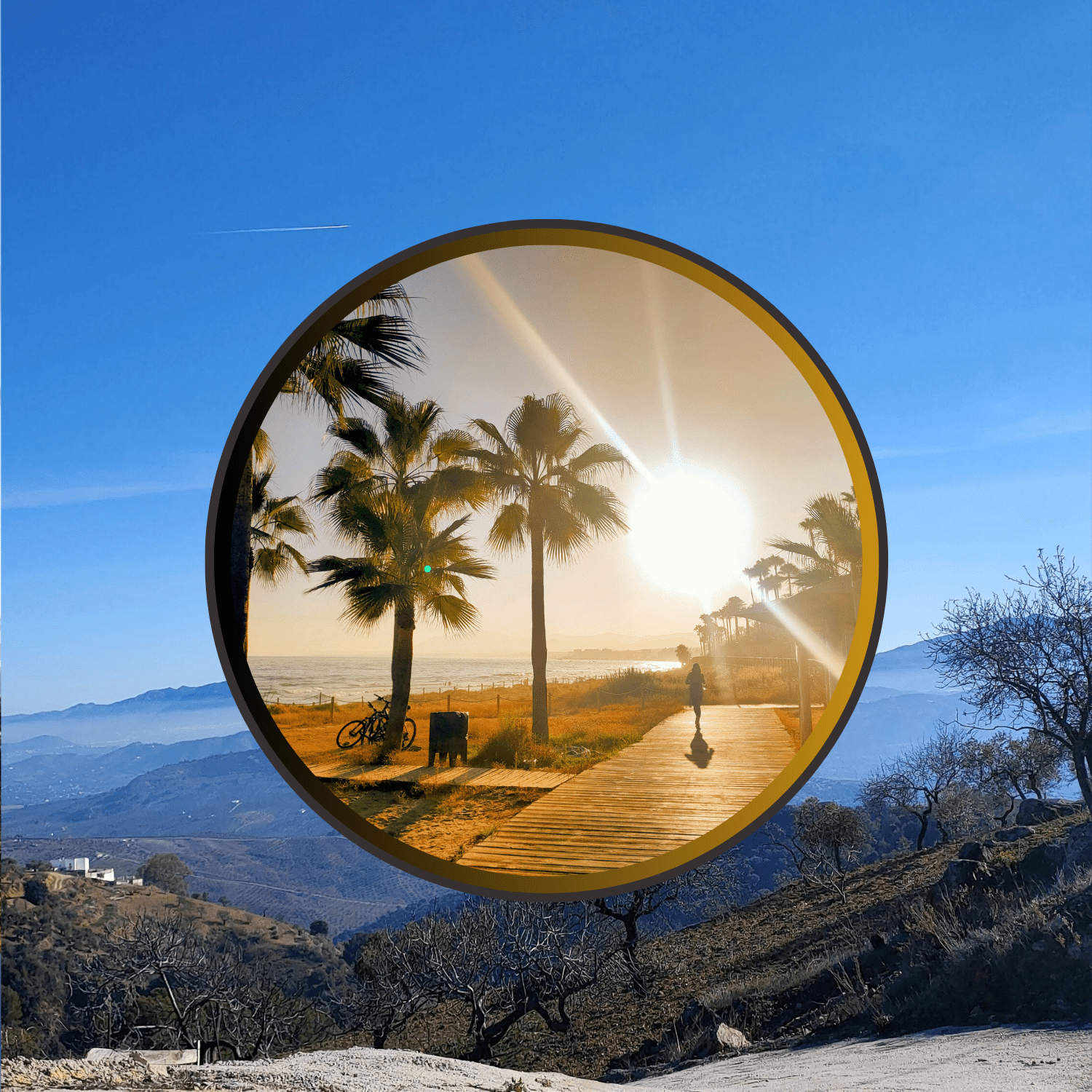

The most obvious advantage is, of course, the climate. Waking up to clear blue skies and avoiding winter clothes does wonders for both mood and health. Many discover they are more active, walking along the beach, and enjoying being outdoors all year round. It’s like gaining an extra dimension of freedom in retirement.

Sure, I’m turning 65, but it must be the warm, bright, and sunny climate that keeps me young! I feel like the picture of health—I can barely remember the last time I had a cold, so my immune system clearly thrives here. Also, the air is so clean and free from car fumes that I really feel energised. People say I look much younger, and I simply believe it’s a side effect of living well on the Costa del Sol!

But it’s not just about the weather. Spain generally offers lower living costs compared to Sweden. Your pension money stretches further, especially when it comes to groceries, restaurant visits, and property taxes. Many describe it as suddenly having a larger financial buffer to truly enjoy life.

Spaniards are also known for their relaxed lifestyle. Dinner is eaten late, the siesta lives on (at least in mindset), and socialising is key. For me, that spontaneous, social culture is one of Spain’s greatest assets.

Economy and Tax: A Complex but Often Favourable Equation

The financial puzzle is often the part that requires the most planning. Spain may not be an outright “low-tax country” like some alternatives, but for many Swedish pensioners, a move still results in a lower overall tax burden on their pension.

For your tax situation to change, you must become a tax resident in Spain (living there at least 183 days per year) and completely sever your essential ties to Sweden. This is when Sweden’s double taxation agreement with Spain comes into effect.

The main rule for taxing Swedish pensions in Spain is simplified as follows:

| Pension Type | Primary Taxation Location | Note |

| Public Pension (Allmän pension) | Taxed in both Sweden (at a low SINK tax of 25%) and in Spain. | You receive a deduction (tax credit) for the tax paid in Sweden, which ultimately lowers your Spanish tax. |

| Occupational Pension (Private Sector) | Normally taxed only in Spain according to Spanish progressive income tax. | This often results in a significant tax reduction compared to Sweden. |

| Occupational Pension (Public Sector) | Taxed only in Sweden. | Governed by specific government-sector rules. |

My personal advice: Always consult an expert in Swedish-Spanish taxation before moving. They can help you optimise your situation depending on the structure of your particular pension income. Many attest that the hassle is worth it, as the annual tax relief can be substantial.

Things to Consider: Bureaucracy and the New Life

No move is without friction. Spanish bureaucracy can be slow, and the paperwork overwhelming. Everything from applying for an NIE number (identification number) and residencia (residence certificate) to declaring taxes can require patience. Many choose to hire a gestor (administrative consultant) to handle this, which I highly recommend.

Furthermore, the move to Spain requires cultural adjustment. The pace is calmer, service can feel slower, and you must be prepared to handle the new environment, perhaps without your immediate family nearby. Although large Swedish communities exist, especially on the Costa del Sol and Costa Blanca, building a new social network can be a challenge.

But for most, the higher quality of life, the amazing light, and the feeling of starting a new, exciting chapter are well worth every piece of paperwork and every waiting period.

Conclusion: Retiring to Spain is not just a move, it’s a lifestyle choice. With the right planning, especially regarding tax and legal matters, it can become the best decision of your life.

Are you currently in the planning phase? Would you like me to search for specific recommendations for Swedish tax consultants in Spain?